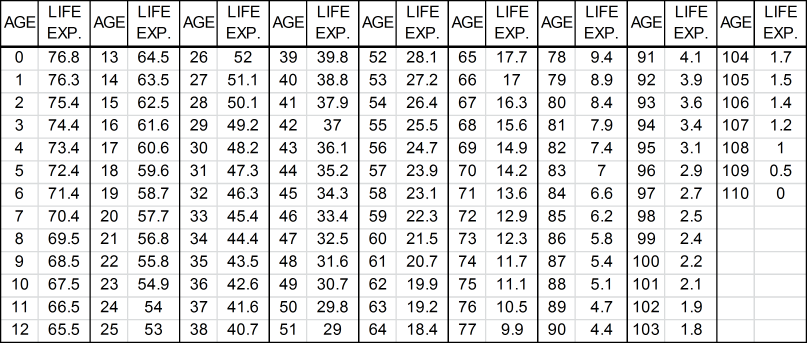

Actuarial present value, mortality tables, RP2014, present value of annuity, scale AA, scale BB, scale MP2014 - Endres Actuarial

General Rule for Pensions and Annuities: IRS Publication 939 by U.S. Internal Revenue Service (IRS) | Goodreads

Calculating Required Minimum Distributions for Inherited IRAs - Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More

SPIA First-In First-Out (FIFO), What's Going On? Old IRS Tables Clash With Current Annuity Pricing – Gary S Mettler

:max_bytes(150000):strip_icc()/sec1035ex.asp-final-a8f06ab6a2f943f3b1524bb72bc4a728.jpg)